Title: Key Factors and Potential Issues in the Debt Negotiation Process

1. Introduction

Debt negotiation, also known as debt settlement, is a process where a borrower and a lender come to an agreement on a reduced payment or a modified repayment plan. This article ms to discuss the key factors and potential issues that one should consider during the debt negotiation process. The following points will be addressed based on the provided corpus: 协商还款需要关注哪些疑问呢英语, 协商还款需要关注哪些疑问呢英文, 协商还款需要留意哪些难题呢, 协商还款需要关注什么, and 协商还款需要准备什么材料.

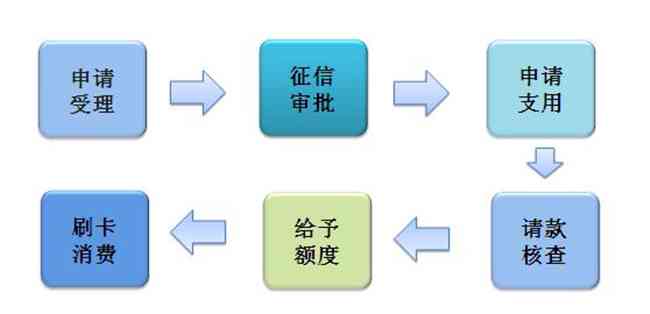

2. Key Factors in Debt Negotiation

1) Communication Skills

2.1 Efficient communication is crucial during the negotiation process. Borrowers need to express their financial difficulties clearly and persuasively to the lender, using ropriate English phrases or terms, such as financial hardship, debt settlement, and repayment plan.

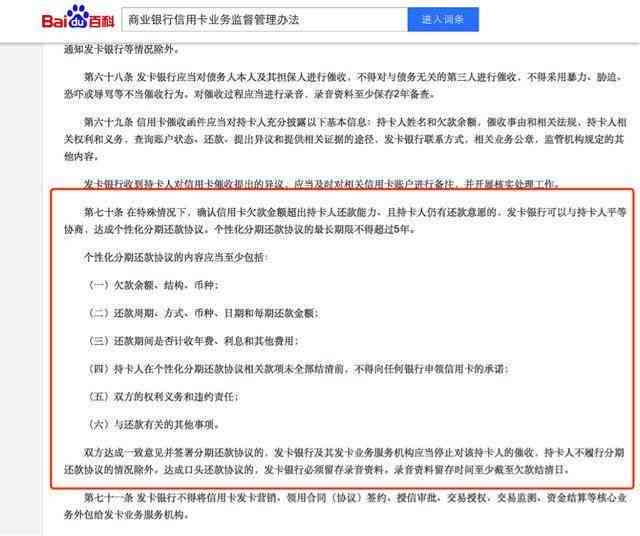

2) Knowledge of Rights and Obligations

2.2 Both borrowers and lenders should have a clear understanding of their rights and obligations under the loan agreement. This knowledge will help in identifying potential issues and finding suitable solutions during the negotiation.

3) Preparation of Financial Documents

2.3 Proper preparation of financial documents is essential to support the borrower's case. These documents may include bank statements, pay stubs, tax returns, and other relevant financial information.

4) Professional Assistance

2.4 In some cases, borrowers may benefit from seeking professional assistance from a debt negotiation expert or attorney. These professionals can provide valuable advice and representation during the negotiation process.

3. Potential Issues in Debt Negotiation

1) Creditor Resistance

3.1 One of the primary issues borrowers may face during debt negotiation is resistance from creditors. Lenders may be hesitant to agree to a reduced payment or modified repayment plan, as it could affect their bottom line.

2) Impact on Credit Score

3.2 Debt negotiation can have a negative impact on the borrower's credit score. A settled debt may be reported as settled for less than the full amount, which can lower the borrower's credit rating.

3) Tax Implications

3.3 In some cases, the forgiven debt may be considered taxable income by the IRS. Borrowers should consult with a tax professional to understand the potential tax implications of debt negotiation.

4) Legal Issues

3.4 Debt negotiation may involve legal issues, such as the enforceability of the modified repayment plan or the validity of the debt. Borrowers should ensure that any agreement reached with the lender is legally binding and enforceable.

4. Materials Needed for Debt Negotiation

1) Loan Agreement

4.1 A copy of the original loan agreement is essential for debt negotiation. This document outlines the terms and conditions of the loan, including the repayment schedule and interest rate.

2) Financial Statements

4.2 Borrowers should provide their financial statements, including bank statements, pay stubs, and tax returns, to demonstrate their financial hardship and the need for debt negotiation.

3) Debt Validation Letter

4.3 A debt validation letter may be required to confirm the validity of the debt. This letter should include the name of the creditor, the amount owed, and the date the debt was incurred.

4) Negotiation Proposal

4.4 Borrowers should prepare a negotiation proposal outlining their desired outcome, such as a reduced payment or modified repayment plan. This proposal should be supported by the financial documents mentioned above.

5. Conclusion

In conclusion, debt negotiation is a complex process that requires careful consideration of key factors and potential issues. Borrowers should be well-prepared, possess effective communication skills, and have a clear understanding of their rights and obligations. By addressing the potential issues and gathering the necessary materials, borrowers can increase their chances of reaching a favorable debt negotiation agreement.

1) Efficient communication skills

2) Knowledge of rights and obligations

3) Preparation of financial documents

4) Professional assistance

5) Creditor resistance

6) Impact on credit score

7) Tax implications

8) Legal issues

9) Loan agreement

10) Financial statements

11) Debt validation letter

12) Negotiation proposal

-

零鬓袅丨协商还款需要注意哪些问题

-

集惟丨协商还款需要怎么操作?

-

操纵适宜丨协商还款需要注意的问题与事项

- 法律帮助丨2020年7月中旬信用卡逾期新规:全面解释影响、应对措与还款建议

- 还款逾期丨农行逾期手续费扣款后能否退还?

- 用卡知识丨农行晚了一天还贷会上吗:还款会产生不良影响。

- 用卡知识丨农行晚一天还款后果解析:逾期利息、信用记录及可能的解决方案

- 用卡知识丨农行信用卡逾期一天会怎么样?需要多久才能消除逾期记录?

- 逾期知识丨农行过了一天算逾期吗?如果农行晚了一天还款,会上吗?

- 停息延期丨农行信用卡还款逾期一天怎么办?如何避免逾期产生?

- 还款逾期丨美团逾期后是否会查看订餐记录:解答您的疑虑

- 还款逾期丨'光大到期还款日没还款,宽限期和分期操作'

- 停息分期丨光大银行逾期还款宽限期及全额还款时间解读 - 如何避免罚息和影响信用?

- 停息分期丨销信用卡逾期记录,如何消除逾期后注销信用卡的信用记录痕迹?

- 法律帮助丨信用卡逾期后尝试与银行协商分期付款遭拒,探讨其他解决策略

- 2024法律咨询丨法务部门协商还款全流程解析:从申请到结案,您需要了解的所有步骤

- 停息分期丨浦发信用卡一天算逾期吗怎么办:解决办法及办理指南

- 平台逾期丨浦发信用卡逾期还款宽限期:一天是否算逾期?

- 用卡知识丨浦发信用卡逾期计算方式及相关疑问解答:一天是否算逾期?

- 平台逾期丨浦发银行超一天还款可以吗-浦发银行超过一天还款

- 停息延期丨浦发信用卡3天宽限期结时间,还款攻略一览

- 法律帮助丨如果你在浦发银行的贷款或者信用卡还款逾期一天,会产生什么后果?

- 停息延期丨信用卡逾期还款凭证在哪开具:完整指南与证明